For 8 weeks now I have been having my physical mail digitized by CAYA. A good time to share first experiences and to give an evaluation of the service.

This recap refers to the article Experiment: Letting private mail be digitized, which I already published on internetzkidz.de in mid-July 2019. The whole thing is part of a real-life experiment that is supposed to make my everyday life more digital.

Experiment setup: Have private mail digitized

To summarize in a few lines what is being judged here:

It bothers me that many companies still send me physical mail because it is cumbersome and inefficient. That is why I have been using the CAYA service since the beginning of July. This service:

- Redirects my letters to you in Berlin

- Opens my mail and then scans my letters

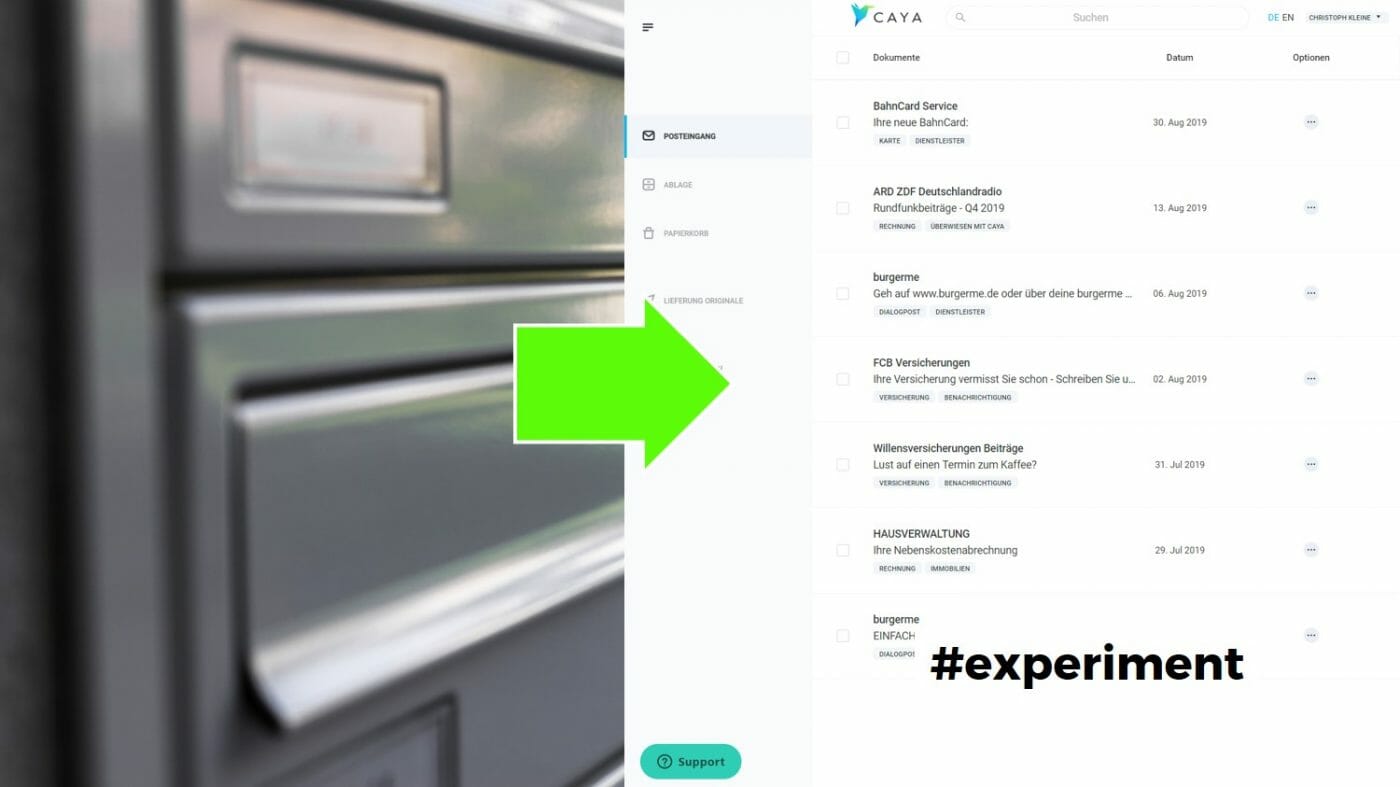

- Presents my letters in an online mailbox via browser or app

- Sends me my letters – if required – collected by post to

What sounds like a no-trainer at the beginning is or was not without doubts for me at the start. On the one hand, I didn’t know if I needed such a paid service and on the other hand I didn’t know if all important documents and items would reach me through it. My main concerns for evaluating the service are:

- What happens to possible gifts of money that are in my letters?

- Will other physical goods (e.g. credit cards) reach me?

- Is the service worth 3€ or 5€ per month?

- Does digital mail give me the benefits I expected?

- Does it reduce the paperwork in my home or does it make my filing easier?

Let’s see …

Management Summary: Have private mail digitized

I am positively impressed with the service. My private mail can be digitally integrated into my everyday life much better than the physical form. The price of 2.99€ or 5.24€ per month is in my opinion value for money.

A few interesting learnings are described in more detail below. These include the very good in-app-payment function and the clear flow for processing mails. But I can also describe some disadvantages or possible problems e.g. for letters with additional items like smart cards.

Advantages and cool features of CAYA

Speed of reaction to letters significantly faster

Now I may be a bad mailbox-goer too, but since I get my letters digitally, I react so much faster to mail that it’s almost unbelievable. If I had a tracking option within the application, my average time between inbox receipt and archiving would certainly be less than 24 hours. And I can even process letters with follow-up actions within an hour for the most part. Typical case:

- I am sitting in the train on my way to work

- I receive a push notification and an e-mail that I have new letters

- I use the app to go to my inbox and open the scanned letter

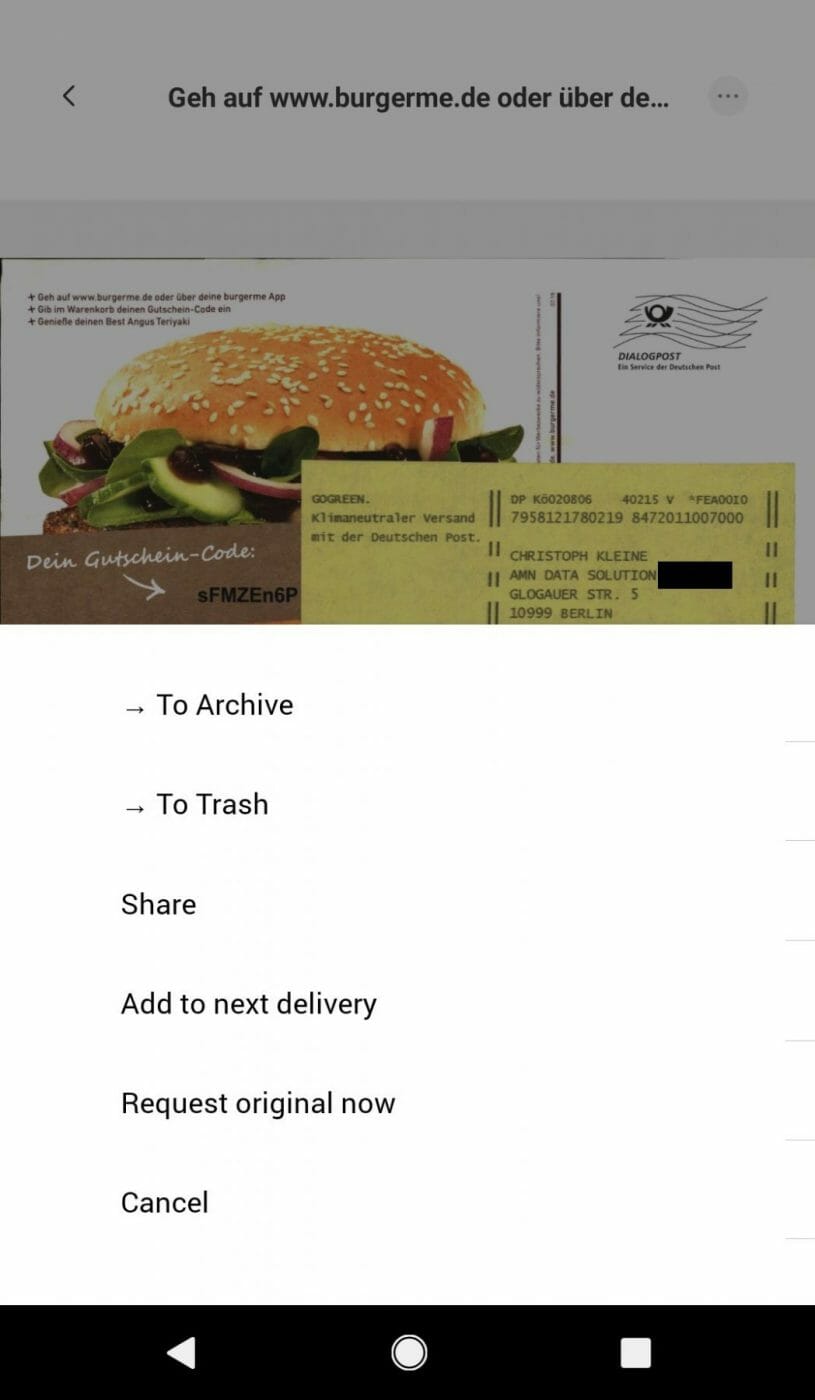

- I decide briefly if it is advertising (deletion), if it is information (archive) or if I need the original at home (add to the collective shipment)

- If someone in the letter from me needs money, I pay quickly without leaving the app (more about this in the next section)

Zack. Within a few minutes, I had my inbox sorted on the way to work. I didn’t have to take an envelope or folder to work and I didn’t have to dispose of anything. On top of that, there was the mental relief of not having forgotten or pushed anything – as esoteric as that sounds.

The whole thing has proven to be especially useful for pseudo-digital letters with action URLs. For example, my health insurance company likes to send me links that are only valid for 14 days or 30 days (which I like for security reasons, by the way). Physically, the deadlines have already passed, digitally not anymore

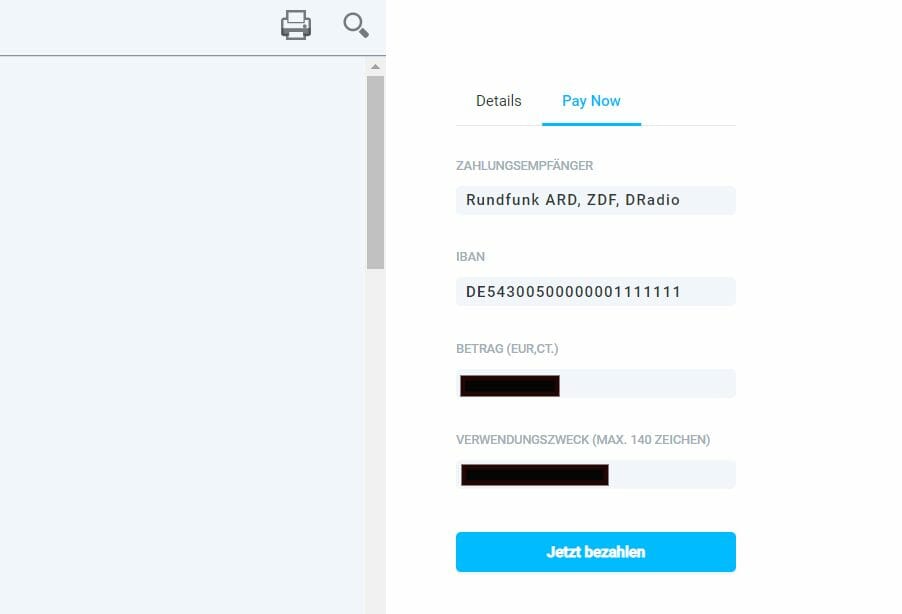

The Payment Solution within CAYA is ingenious

In the previous section already tasered briefly, here now in detail: CAYA has a payment-function within the inbox. And in addition, the technology can read out the included remittance slips during the scans. A powerful combination that leads to maximum convenience. That was the killer feature of the service for me and kills a lot of my work with letters at once.

Step by step I imagine it like this:

- One of my letters is scanned

- The scan technology recognizes a transfer slip on one of the sheets

- An OCR function extracts data in the familiar fields such as recipient, IBAN, subject, amount, etc.

(It is possible that even a poor working student has to enter things manually here, but the fact that I can mark the numbers in the .pdf files speaks for an OCR solution) - The extracted data is used to fill in a form next to the letter. This can be reached via a Pay Now button.

- I am redirected to the service of fintech systems, which, similar to the service instant bank transfer, allows me to login to my bank and initiate the transfer

- I confirm the payment via my banking app and the problem is solved.

User flow and functionality are really good. Unfortunately I can’t judge whether it works that well for non-digital banks. For N26, however, the flow is very good.

But I can still give a small hint about the functionality. It is not always possible to read out the different fields in the remittance slip without problems. Therefore, check the correct pre-allocation of the fields before you go into a payment transaction. In the last weeks I had a case in which a number pad consisting of three digits was cut off at the end of a payment purpose.

The paper war ends here / digital spam

How often do I really still need the originals of a letter at home?

This was one of the key questions I asked myself at the beginning of the experiment. The answer so far: As good as never! From the letters of the last weeks I had to get a letter sent to me first and that was my Bahncard (more about this in the negative section). But even the consignment I needed not because of the letter, but because of the plastic card!

A small highlight were the mailings from burger.me, which I have now as .pdf. CAYA scans not only important things, but also every advertisement, which should be sent to me personally as a mailshot. Now I could look at the burger.me action menus every Monday on my smartphone instead of sending them directly to the waste paper. 😀

Furthermore, I can now see which advertisers have their notes sent centrally by mail and which have messengers walking around the neighborhood and visiting each mailbox individually.

Disadvantages and open points in the experiment evaluation

Not all mail is the same

As already described in the experiment setup, a redirection order at the German Post Office allows me to use this service. However, in Germany not only the German postal service sends letters to residents (although the majority). Unfortunately, letters that are not sent through the envelope centers of the German Post cannot be forwarded to CAYA and scanned. Accordingly I still receive – partly important – letters in my mailbox.

Commerzbank is one of the strategists who sends things like deposit overviews or account statements – probably for cost reasons – via the provider Postcon. These then end up in my physical inbox as normal.

Unfortunately, this is a bit annoying, although understandable. Maybe this coverage will be added in the further development of the service.

Where is my Bahncard?

An interesting circumstance that has arisen during the experiment is the renewal of my Bahncard50 in September. I have known the ritual for seven years already and it is exciting every year because the card is physically delivered to me by mail.

This year the invoice came already on 25.08. by e-mail (which was very cool), the actual card reached me on 30.08. in my CAYA mailbox. But this also means that I have to live 5 days in agonizing uncertainty if my new Bahncard would reach me this year in time and at all. Now I have the certainty that it is there. But it still has to be sent to me from Berlin.

Fun fact on the side: I don’t have to fare evaded, because for about 1.5 years now, the Bahn has automatically provided every Bahncard for logged-in users in the DB app.

I really get less letters than I thought!

Positive for me, bad for the experiment. I really get less letters than I thought. This also means that my statements have less significance for this recap and that I could not test some use cases yet. These are e.g.

- Receipt of money in letters (If you want to get involved here, you are welcome to send me money by mail. To ensure a certain significance here, I suggest large bills > 100 Euro)

- Routing of packages I ordered e.g. via amazon (I actually have everything sent to the office). This should not be sent to Berlin, but I haven’t tested it yet.

- Documents with long, detailed forms and the request to return them (I’d like to give the city of Düsseldorf as an example, which sent me a questionnaire on citizen satisfaction a few months ago. This survey would easily have cost me half a working day if I had filled it out).

Maybe I’ll just have to wait for the turn of the year and then see if there are any new use cases.

By the way, the amount of letters justifies the costs anyway. The fast response times and Peace of Mind alone were worth the money in my opinion.

Responsive Web vs. App – a discussion with potential

One small shortcoming that I still found is the provision of mobile services. For a seemless smartphone experience you definitely need the appropriate Android or iOS app. This is not uncommon for many offers nowadays. However, the website or mobile customer portal lacks a smartphone view. Users who try to view their letters on the go via the mobile browser are kindly advised to obtain the app from the corresponding app store.

Even if this does not restrict the use of the service, I think it is part of the concept that people who are not committed to app economy should be given the opportunity to use the service in their browser – on any device.